Facts, Figures & Timelines

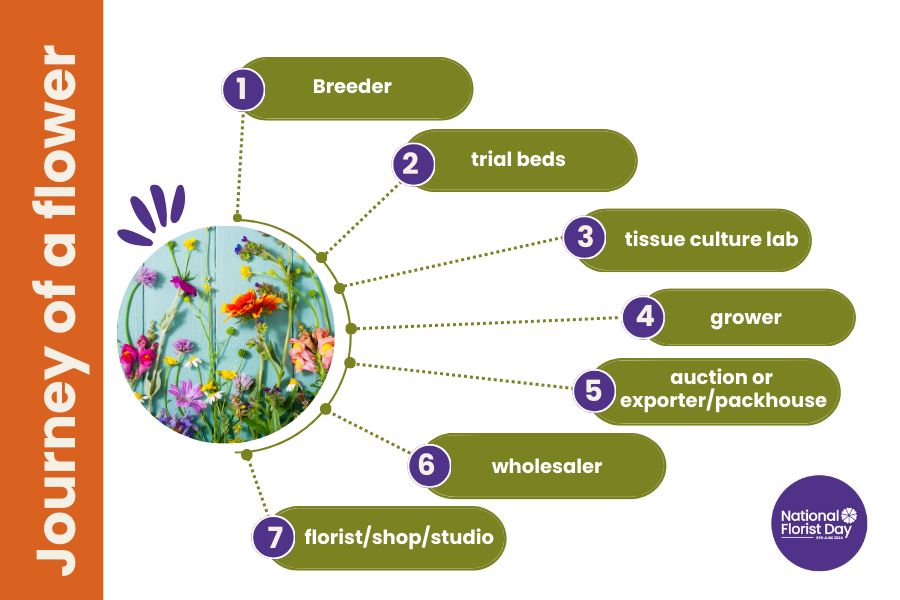

How the chain works

12 years, 10 weeks and 24 hours!

Creating and finally delivering a flower to the end consumer is huge, complex, and totally global. In fact, a flower could have been through several countries before it makes it to its final destination for commercial production … and that includes the UK. There are very few – if any – flowers that begin and end in the same country.

It all starts at the breeders, and they can be based anywhere. Japan, Colombia, the Netherlands and Israel are home to some of the world’s leading flower breeders, and it can take up to 12 years to produce a bulb/corm/cutting/root plant that is suitable for mass production.

During the breeding programme the flower or plant will be sent to trial fields to test for suitability, disease resistance and commercial viability and again that will happen in different parts of the world … both for economy and to test various growing conditions.

Once it has been deemed suitable and available for full scale production it will go through tissue culture processing to ensure a consistent supply of quality stock. Here Costa Rica plays a dominant role as does India where one of the biggest facilities provides work for over 1200 women who would otherwise find employment difficult.

Only then will it make its way to the grower … be it UK, Colombia, Kenya, The Netherlands, Ecuador et al for commercial production who will plant, grow and cut a crop in around 10 weeks depending on the flower.

From the grower it is sent to either the auction where it will go on general sale or to an importer for onward sale if being bought by a supermarket or large online operator like Bloom & Wild. It could also go direct to a wholesaler if they are buying in sufficient quantity.

From the wholesaler it will go to the florist, garden centre, general store and be used and delivered to the final customers.

Perhaps the most amazing part is that whilst it may take many years to breed a flower, from the point at which it’s cut at the growers and delivered to a florist can take less than 24 hours depending which country it has come from.

How the numbers stack up

Statistical information for the flower industry is complex and relatively thin on the ground … which could be why some companies don’t even try to include any financial breakdown whilst others seem to use very odd, and to our mind, very questionable data … we’ve even seen our own used without permission!!!

It also tends to be fairly old. We regularly see 20 year+ figures from a defunct organisation being quoted – and it often doesn’t drill down to the whole chain nor take into account the fast-moving changes which can have an impact on the numbers.

So, whilst we can bring you some fairly accurate high-level numbers from some trusted sources, we’ve added in some of the unique insights we have as one of the leading trade magazines for the sector.

- According to The International Association of Horticultural Producers (AIPH) in 2021 the global flower industry was worth approximately £64billion from an estimated 650,000 hectares of growing space.

- The three biggest areas of production are The Netherlands with around 46% market share followed by Colombia and Kenya. However, as costs go up, production is reducing in The Netherlands and growers are transferring their skill base to more economical locations.

- UK grown flowers account for around 15% of flowers sold in the UK – British Flowers Week takes place at the same time as National Florist Day.

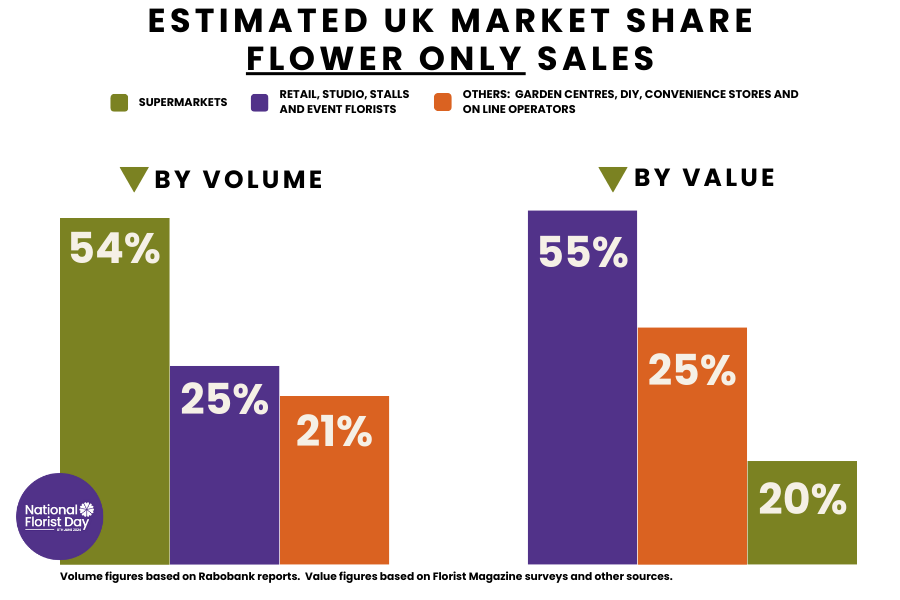

- Retail sales of flowers and plants in the UK are estimated to be worth £2.5 billion with, according to Rabobank figures from 2021, independent florists, studios and stalls accounting for around 25% of sales, predominantly in the higher value gift and special occasion categories. Our own deep drill means we would probably put the market share a tad higher, especially given the anecdotal information we have heard about supermarket sales and the known drops at Bloom & Wild et al.

- The UK has the highest level of supermarket and online sales in the world. According to 2021 figures from Rabobank, supermarkets in the UK accounted for approximately 54% of sales compared to circa 14% in France and 20% in Holland. This dominance brings a set of challenges for independent florists, in the UK particularly, unlike any other country. With their huge buying power supermarkets are, at certain times of the year, able to offer flowers at a lower cost than traditional florists can buy at wholesale level. The quality may not be the same, but it is a perceived price difference that can be difficult to counter and compete with.

- By 2025 The Flower Sustainability Initiative aim to have 90% of all imported flowers meet the expectations and exacting standards in terms of good growing practices and social sustainability.

- Like all small independent businesses, local florists have faced huge challenges in the last few years – particularly in relation to rising cost of goods and running costs. Whilst flower prices have remained stable for the last couple of years others have risen by over 25% per cent since 2020.

- Back in 2016 and based on The Florist Trade Magazine’s database, there were over 8,000 full service, traditional High Street florist shops in the UK. Today that number has dropped to around 5,500 with a dramatic increase in the number of florists working from home or purpose-built studios. However, whilst the overall number remains pretty constant and some traditional bricks and mortar shops have grown sales, the switch in trading styles has resulted in many more micro businesses with far more recording turnovers under £83k in the 2023 Florist Magazine industry survey. This in turn impacts on suppliers who are having to serve more customers to maintain and grow their sales levels.

The impact of Covid, War and Brexit

Covid had a dramatic impact on the flower industry and in many ways very positive. Used as the natural connector between people not able to see each other, pretty much every retailer saw huge uplifts in the sale of flowers and plants although the loss of weddings and events had a major impact on florists who specialised in these areas and caused many business shutdowns.

Once restrictions ended, those sales plummeted as consumers returned to socialising, holidays et al. Whilst some independent local florists have managed to retain a lot of the growth, the majority are back to 2019 levels. However, other channels have seen huge losses, notably online players like Bloom & Wild and Freddies Flowers who have both reported dramatic drops.

The impact of war between Russia and Ukraine has been tough. For Dutch growers it caused a huge increase in costs, notably in heating and lighting and why so many have invested huge amounts in LED lighting whilst others have simply closed down, merged or switched crops.

The impact of Brexit is ongoing. Whilst the removal of the 8% tariff on 3rd Country imports has helped this has been countered by the increasingly expensive and time-consuming system of bringing flowers into the UK. Postponed several times, the long-awaited Border Controls were finally introduced in April 2024 and have caused major delays due to greater levels of inspections. The new systems have also added extra costs for wholesalers who not only have to pay the inspection fees but also cover the cost of producing far more documentation than pre-Brexit.

Whilst it won’t add huge prices increases for florists it does mean they will have to rethink their buying habits and order 24 hours earlier to take into account the risk of delays and potentially not having flowers arrive in a timely way for key events like weddings and funerals.

The cost-of-living crises and rampant inflation has also had an impact. Whilst local florists are somewhat more protected than other retail channels as the majority of their sales are for special occasions and events rather than non-discretionary impulse purchases, it has impacted in other ways. For example, higher wage costs, an increase in the cost of sundries and services and for those already in or trying to make a move from High Street to industrial units, big rent increases as space becomes a premium.

Reference sources

Rabobank 2020 – 2023

Florist Trade Magazine 1994 – 2023

DEFRA 2020

AIPH 2021

© Purple Spotted Media Services Ltd/Caroline Marshall-Foster

This statistical information and overview are part of a bigger intelligence report ‘Flower Power: The Florist Industry Revealed’ by Caroline Marshall-Foster and Purple Spotted Media Services Ltd. No part may be reproduced or used without the permission of the copyright holders.